Prices are driven by supply and demand and therefore may prove to be volatile and speculative, while values are determined by trends related to market fundamentals: rents, construction cost, new supply, and wages. If all borrowers paid cash or put down a substantial down payment, our interest in and concern over this difference would be much less. But in today's home finance market, leverage matters, in particular because it can have a large impact on price.

The following are core principles of housing finance that were articulated in the first half of the Twentieth Century:

This two, from 1903, are the most important:

The next five provide additional insight:

Intrinsic Home Value refers to the value of a home determined by analyzing fundamentals without reference to its market price. The first three charts relate house price appreciation associated with the subject property's price tier to (i) construction costs, (ii) wage growth, and (iii) rents. The fourth chart relates the subject property's house payment to its rental value, which provides a measure of its ability to earn its way out the mortgage debt.

Speculative elements drive up the market price to a level well above the intrinsic value. This higher market price relative to intrinsic value should be considered by the lender as speculative elements enhance the risk of loss should the price recede closer to intrinsic value.

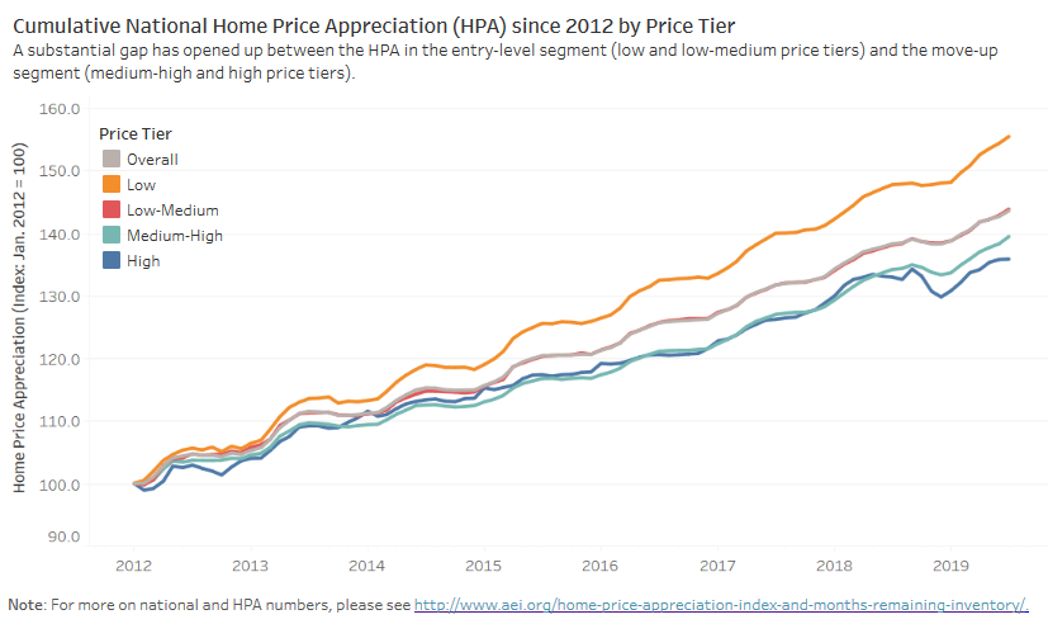

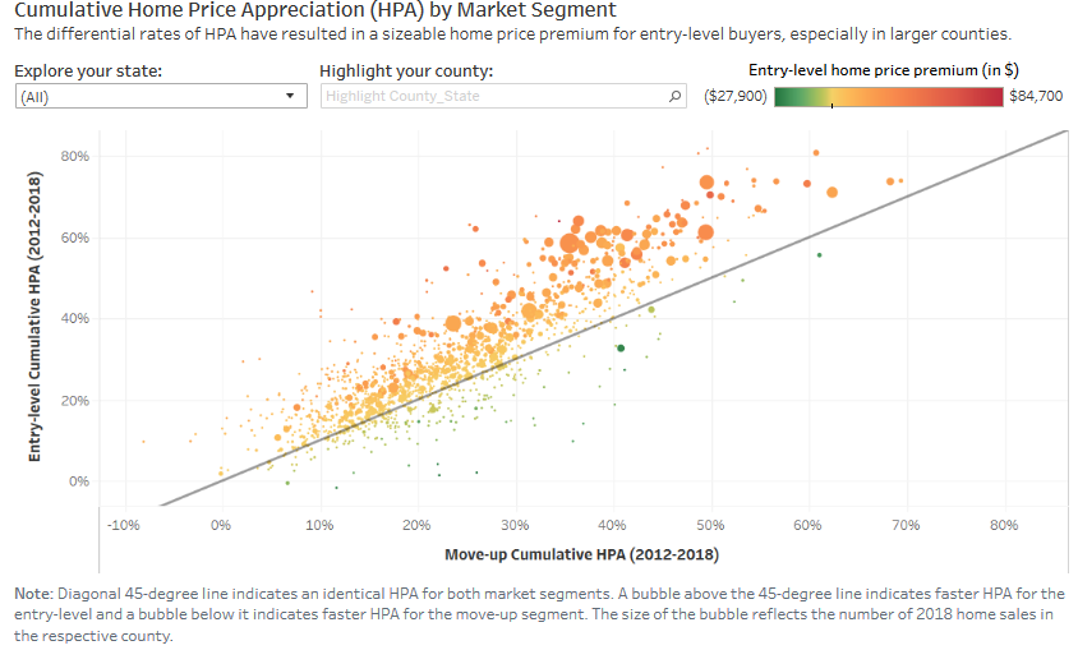

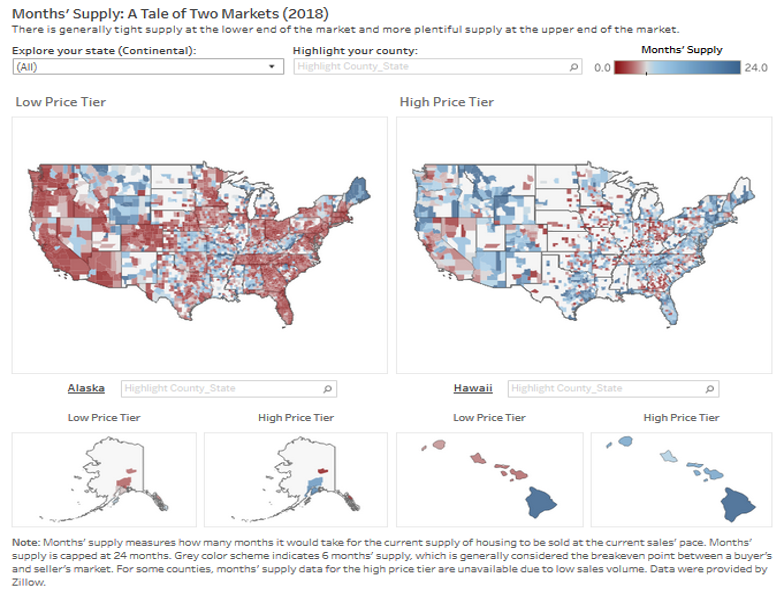

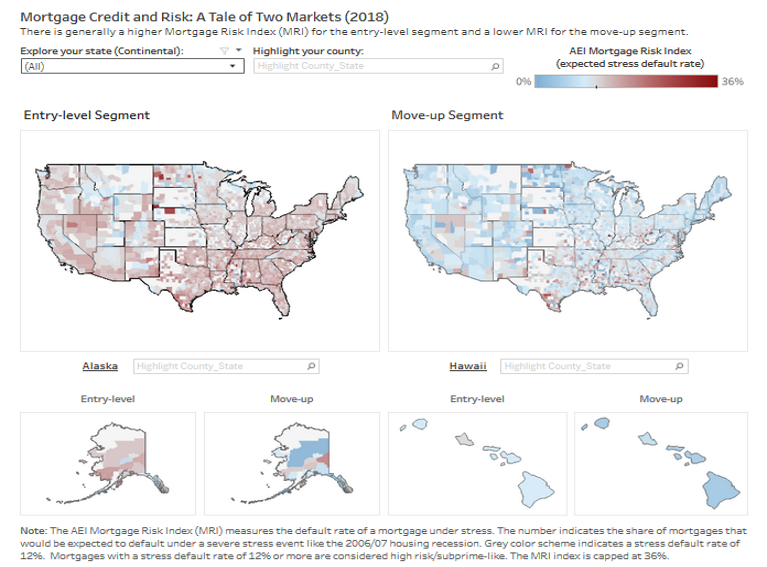

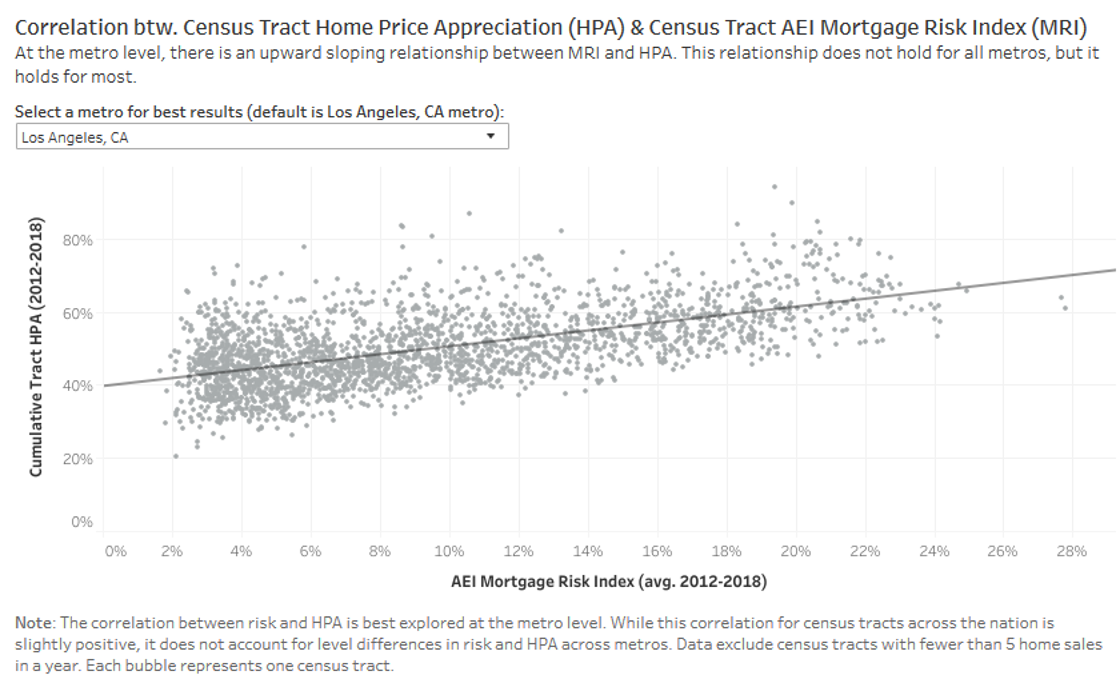

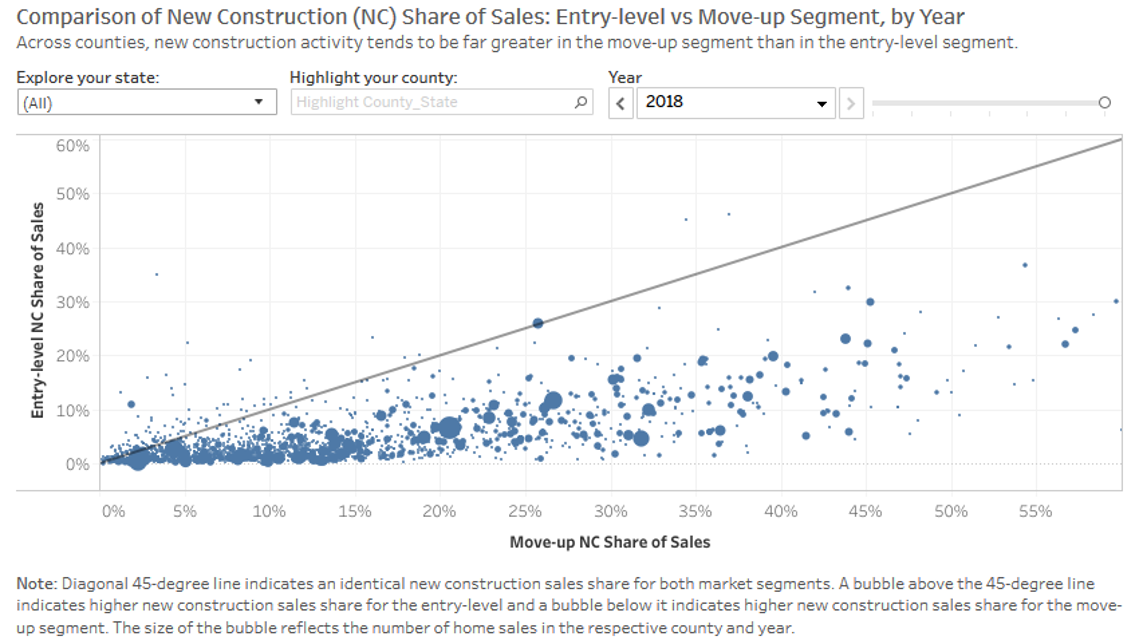

Our research has found that home price appreciation, supply and demand, mortgage risk, and new construction supply are all sensitive to price tier within a local market. In terms of price tiers, the MTR uses either entry level vs. move up or low, low-medium, medium-high, and high, both by market.

Market by market, lower price tiers consistently have these correlations:

Higher home price appreciation

Note: The entry-level segment consists of the low and low-medium price tiers and the move-up segment consists of the medium-high and high price tiers.

Lower month's remaining inventory during a boom, reflective of a supply/demand imbalance 8

Higher mortgage risk

8 Month's inventory at current selling rate is generally inclusive of other indicators such as: days on market and inventory of listed properties. Other indicators such as: how many listings have been withdrawn, foot traffic, how many listings have been reduced, and cancelled appraisal orders; may be useful in developing an opinion on whether a long term market trend is changing.

Lower additions to supply as a result of new construction

A massive amount of granular data had to be compiled from a wide range of sources. Those data then needed to be turned into market trend information, that would allow the user to analyze the information and develop an opinion regarding the relationship between price and value.